Importance of flood zone information

The why

Determining whether or not a property lies within the 100-year flood plain is a process that is critical for many – land developers, land surveyors, architects, insurance professionals, rental investors, real estate professionals, mortgage lenders, property owners – the list goes on and on and on.

The reasons that knowledge of this information is critical are as numerous as those that benefit from the knowledge, but at the end of the day the bottom line is quite simple - Risk Analysis.

The risk, as FEMA has defined it, is: a property that is located within the 100-year flood plain has a 1 in 4 chance of experiencing a flood event over a loan period of 30 years.

Regardless of whether or not a loan transaction is part of the equation, or whether or not a structure lies on the subject property, a property located in a high-risk area can certainly be problematic, therefore defining and understanding that risk is critical.

Determination process

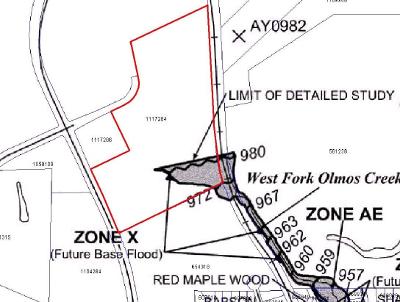

Flood Zone Determinations are made using FEMA flood maps. Typically, states are mapped at the county level, and each county has an office that acts as the repository for their flood maps. Once a county has been studied, several individual maps that cover the entire county will be created, including an index map. These individual maps are called map panels, and each map panel has a scale. Small counties have a small stack of panels and some large counties have stacks upon stacks of panels.

As each map panel defines a particular area, the first step in the determination process is finding the correct map panel that covers the subject property. From that point, it is simply a matter of plotting the location of the respective property.

Since flood maps look similar to street maps, they’re pretty easy to navigate. How they differ from most maps is that they also display a unique layer of information known as flood zones. Some flood zones are high risk, others are not, but the fact is – every bit of mapped area is in one flood zone or another.

Once the property is defined on the flood map panel, a determination can be made as to whether or not the property has exposure to the high-risk flood zone.

If additional tools are used in the determination process, an aerial photo can be included in the graphics to display a structure, or structures, as they relate to the high-risk area.

More on flood zones

Typically, you’ll see flood zones described based on flood insurance requirements. In other words, ‘insurance is required in these zones abc, and flood insurance is not required in these zones xyz.’ The best example of this is regards to mortgage transactions.

However, proper risk analysis is not a matter of whether or not flood insurance is required. In other words, flood insurance is not a cause, it’s an effect. Given that nearly 20% of all flood claims are for properties located in a moderate-to-low risk area, one would be foolish to think otherwise.

The best way to differentiate flood zones is relative to risk, as is the case with official FEMA descriptions:

Definitions of FEMA Flood Zone Designations

Flood zones are geographic areas that the FEMA has defined according to varying levels of flood risk. These zones are depicted on a community's Flood Insurance Rate Map (FIRM) or Flood Hazard Boundary Map. Each zone reflects the severity or type of flooding in the area.

Moderate to Low Risk Areas

In communities that participate in the NFIP, flood insurance is available to all property owners and renters in these zones:

| Zone |

Description |

| B and X (shaded) |

Area of moderate flood hazard, usually the area between the limits of the 100-year and 500-year floods. Are also used to designate base floodplains of lesser hazards, such as areas protected by levees from 100-year flood, or shallow flooding areas with average depths of less than one foot or drainage areas less than 1 square mile. |

| C and X (unshaded) |

Area of minimal flood hazard, usually depicted on FIRMs as above the 500-year flood level. |

High Risk Areas

In communities that participate in the NFIP, mandatory flood insurance purchase requirements apply to all of these zones:

| Zone |

Description |

| A |

Areas with a 1% annual chance of flooding and a 26% chance of flooding over the life of a 30-year mortgage. Because detailed analyses are not performed for such areas; no depths or base flood elevations are shown within these zones. |

| AE |

The base floodplain where base flood elevations are provided. AE Zones are now used on new format FIRMs instead of A1-A30 Zones. |

| A1-30 |

These are known as numbered A Zones (e.g., A7 or A14). This is the base floodplain where the FIRM shows a BFE (old format). |

| AH |

Areas with a 1% annual chance of shallow flooding, usually in the form of a pond, with an average depth ranging from 1 to 3 feet. These areas have a 26% chance of flooding over the life of a 30-year mortgage. Base flood elevations derived from detailed analyses are shown at selected intervals within these zones. |

| AO |

River or stream flood hazard areas, and areas with a 1% or greater chance of shallow flooding each year, usually in the form of sheet flow, with an average depth ranging from 1 to 3 feet. These areas have a 26% chance of flooding over the life of a 30-year mortgage. Average flood depths derived from detailed analyses are shown within these zones. |

| AR |

Areas with a temporarily increased flood risk due to the building or restoration of a flood control system (such as a levee or a dam). Mandatory flood insurance purchase requirements will apply, but rates will not exceed the rates for unnumbered A zones if the structure is built or restored in compliance with Zone AR floodplain management regulations. |

| A99 |

Areas with a 1% annual chance of flooding that will be protected by a Federal flood control system where construction has reached specified legal requirements. No depths or base flood elevations are shown within these zones. |

High Risk - Coastal Areas

In communities that participate in the NFIP, mandatory flood insurance purchase requirements apply to all of these zones:

| Zone |

Description |

| V |

Coastal areas with a 1% or greater chance of flooding and an additional hazard associated with storm waves. These areas have a 26% chance of flooding over the life of a 30-year mortgage. No base flood elevations are shown within these zones. |

| VE, V1 - 30 |

Coastal areas with a 1% or greater chance of flooding and an additional hazard associated with storm waves. These areas have a 26% chance of flooding over the life of a 30-year mortgage. Base flood elevations derived from detailed analyses are shown at selected intervals within these zones. |

Undetermined Risk Areas

| Zone |

Description |

| D |

Areas with possible but undetermined flood hazards. No flood hazard analysis has been conducted. Flood insurance rates are commensurate with the uncertainty of the flood risk. |

* Source: www.fema.gov

The last one, Zone D, may be a bit confusing, but it is basically referencing an area in a mapped community that was not studied – some of the county was studied, some was not.

What about a county that has not been studied at all? In that case, the zone used most often is the word “NONE”. Regardless whether its ‘D’ or ‘NONE’, the point to be made is clear – risk may be present, it just has yet to be defined.

Action

Once a determination is complete, the result may lead some to action. In some cases, as in the aforementioned mortgage transaction, the purchase of flood insurance will be the end result for a structure affected by a high-risk zone.

For others, the result may lend towards aggressive mitigation efforts, e.g. building location, grading level, construction regulation, and structure elevation. For others, it may impact valuations and purchase offers. And for some, it may be a combination of mitigation efforts and flood insurance, as well as the need for further impact analysis.

Summary

Accurate flood zone information is a critical component towards a successful risk analysis. However, if taken for granted, its importance minimized, or the process in which the information is acquired is marginalized, the result can be quite devastating.

For more information please send inquiries to: info@floodsearch.com